[ad_1]

Below are loans offered by Kenversity Sacco, how to apply and documents required.We also provide saving account details and contacts:

Membership Requirements

Membership Eligibility

Kenversity Sacco’ Membership is open to all Kenyan Nationals anywhere in the World. For Individual Membership, to join the Sacco one needs to:-

1. Complete Membership Application Form

2. Attach a copy of national ID or a valid passport

3. Attach 2 passport photographs

4. Appointment letter from employer if employed

5. Entrance fee of a total of kshs.1,000

Membership Classes

Platinum- A

Definition- These are members whose employers have a check off agreement with Kenversity Sacco. These members’ pay slips are used as the basis for appraisals during loan applications. These members enjoy loans without necessarily providing physical collateral/security, but with guarantors, salary and deposits as security. These members have voting rights. Members in this category are employees on contract of two (2) years or more, or employees on permanent and pensionable basis at their places of work. These members can vie for elective positions at the Sacco.

Platinum-B

These are members with short term contracts of less than two years but more than six months. These members enjoy all the rights of members in Platinum-A except vying for elective positions at the Sacco. This is to ensure continuity of leadership at the Sacco.

Gold

Definition- These are members of the Sacco by the virtue of operating certain accounts or patronizing certain products e.g. fixed deposit accounts, business accounts, special investors at the Sacco, e.t.c. The basis of appraisal for these members during loan application is their account operations and assessment of their businesses (for business account holders). Members in this category are individuals with a source of income apart from salary. These members sign a contract with the Sacco that allows for attachment of personal property (collateral) which may be auctioned in case of loan default. These members have voting rights but are not eligible to be elected.

Diamond

Definition- These are members who are organized in groups as shall be prescribed by the Sacco from time to time: Organized groups from institutions with check off system but where employment contracts run for six (6) months or less. Organized groups that are registered with the relevant Government authority.

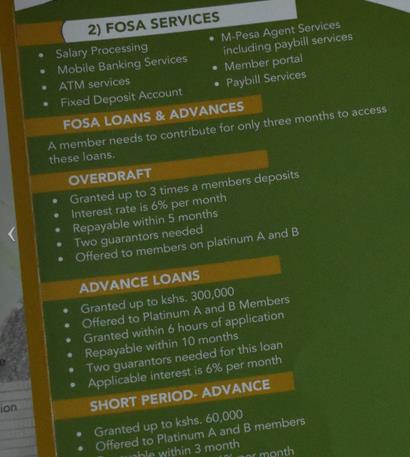

FOSA Products

| Type | Limits | Repayment | Rates | Guarantors |

| Overdraft | 20,000 – 300,000 | 10 Months | 6% | 2 |

| Advance | 5,000 – 100,000 | 5 Months | 6% | 2 |

| Short Period Advance | 60,000 | 3 Months | 6% | 1 |

| Karibu | 100,000 | 6 Months | 5% | 2 |

| Jiinue | 100,000 | 6 Months | 5% | 2 |

| Utility | Nil | 12 Months | 2% | 2 |

| Share Booster | up to 100% of your deposit | Once upon loan approval | 10% | Nil |

Common Conditions

1. The loans are granted based on the ability to pay.

2. The current pay slip (Not a run) is a requirement.

3. Guarantorship by diamond members is not allowed.

4. Top-up is acceptable except for Utility and share-booster.

N/B: Fosa products are processed within eight (8) hours least for utility loan.

Two guarantors for Fosa loans

Overdraft – It is repayable in 10 months. Minimum kshs. 20,000 and Maximum Kshs. 150,000.

Advance – It is repayable in 5 months. Maximum Kshs. 60,000 – two guarantors for non-KU members.

Short Period – It is repayable in 3 months. Maximum Kshs 20,000.

Karibu Loan – The loan is repayable in 6 months Maximum of kshs. 100,000. Can be granted even on the first month of the member joining the SACCO, only if he/her pay kshs, 3000 share capital and risk Kshs.300. interest rate 5% per month.

Jiinue Loan – The loan is repayable in 6 months Maximum of kshs. 60,000. interest rate 5% per month.

All are applied and granted within the same day.

Top-Ups

Members can apply for top-ups on all FOSA loans and emergency with a clearing fee of 4% on the balance.

Utility Loans

>Repayment period is 12 months.

>Interest rate 2 % per month.

The utility loans include:

1. Car Insurance

2. Hot point Appliances

3. AA Driving Lessons

4. Mobile phones

5. Mabati

6. Jikos & Solar products

7. Tanks

Payment Methods

Cheque

-All cheques are payable to Kenversity Sacco Limited. Please indicate on the Cheque, your Membership Number/Id number and the allocation e.g:-

> to pay KES 60,000, indicate on the cheque, your membership

> Number- MNO.001-Deposit Kshs.10,000/-

> Risk Management Fund Kshs.300/-

> Normal Loan , KES 15,000/- and

> Super loan KES 34,800/-

Bank

Co-operative Bank of Kenya Ltd

Account Name: Kenversity Sacco Ltd

Githurai Branch

Account Number : 01120000563800

National Bank of Kenya Ltd

Account Name: Kenversity Sacco Ltd

Kenyatta University Branch

Account Number : 01009059073700

M-pesa Paybill: 577820

Cash

A member can deposit his/her monies over the counter by cash or cheque at Kenversity offices at Kahawa office.

FOSA Savings Accounts Terms and Conditions

Savings accounts:

1. Kenversity Savings Account (Kensa)

– This is where your loan is channeled and withdrawal is made from this account. Requirement for opening Account:

> A copy of Id

> Two passport

2. Kenversity Junior Savings Account (Kenjunior)

– This account enables members to save for their children under (18) years.

– The parents/guidians must be members of the SACCO.

– Two passport size photos of the child shall be required.

– Withdrawal Shall be limited to once a year.

– Free piggy bank shall be given to the account holder.

– The account shall be ledger fee free.

– Savings Ammounting to Ksh. 100,000 and above shall attract an interest of 5% p.a.

3. Kenversity Holiday Savings Account (Kenhol)

– The account shall be intended for holiday purpose including Christmas, Islamic Holidays, Easter Holidays etc.

– Eligible customers shall be 18 years and above.

– The Customer shall be required to fill-in an account opening Form.

– Withdrawals shall be limited to twice a year.

– Interest rate 10% for savings of Ksh. 100,000 and above will be paid to the account holder to facilitate travels. (This will be credited in the members Kenhol account).

4. Kenversity Fixed Deposit Account (Kenfix)

– The account allows members to save for a certain period of time in order to earn interest.

– The members decides the period of savings, and after expiry the account holder can renew.

– The interest rate is determined by Board of Directors from time to time.

– Current Fixed Deposit Rates:-

| SN | Amount Invested | 1 Month | 3 Months | 6 Months | 9 Months | 12 Months |

| 1 | 5,000-49,999 | 4% | 4.5% | 5% | 5.3% | 5.5% |

| 2 | 50,000-399,999 | 4.5% | 5.5% | 6% | 6.3% | 6.5% |

| 3 | 400,000-999,999 | 6.5% | 7% | 7.5% | 7.8% | 8% |

| 4 | 1M-2,999,999 | 7% | 8.5% | 9% | 9.3% | 9.5% |

| 5 | 3M-4,999,999 | 8.5% | 9% | 9.3% | 9.5% | 10% |

| 6 | 5M-9,999,999 | 9% | 9.3% | 9.5% | 10% | 10.1% |

| 7 | 10M and above | 10% | 10.2% | 10.4% | 10.6% | 10.7% |

5. Kenversity Education Savings Account( Kened)

– The account shall be intended for education purpose.

– Eligible customers shall be 18 years and above.

– The customer shall be requiered to fill-in an account opening Form.

– Withdrawals shall be limited to three times a year.

– The withdrawals shall not attarcat any withdrawal fee.

– Savings amounting to Ksh.100,000 and above shall attract an interest of 5% p.a. at the end of the year.

Top Ups

Members can apply for a top-up of FOSA and BOSA Loans and will be charged a clearence fee of 2% on the outstanding balance. Members can also apply for a kenversity loan to clear external Bank Loans. A clearence fee of 4% will be charged.

Contacts

Main Branch:

Kahawa Sukari Area, Kahawa Sukari Avenue, Behind Quickmart Supermarket, Nairobi, Kenya.

Postal Address:

P.O.Box 10263-00100 Nairobi,Kenya.

Phone Number:

0715 114454

020-8002371/2

Email:

info@kenversitysacco.co.ke

[ad_2]

Source link